E-commerce Installment Payment System

September 9, 2019 7:10 amWhat is it?

In a previous blog we showed that the internet and your business website can positively affect all areas of your business operations. Now we can show how a new form of online payment system can improve your sales by allowing your customers to purchase from your store and receive the purchased item immediately, but be able to pay it off in installments at no extra cost or interest charges to them.

There are many customers who use the old lay-by system and they and other customers will be attracted to the new installment payment systems as they receive their purchase immediately and don’t have to wait until they have completed their lay-by payments.

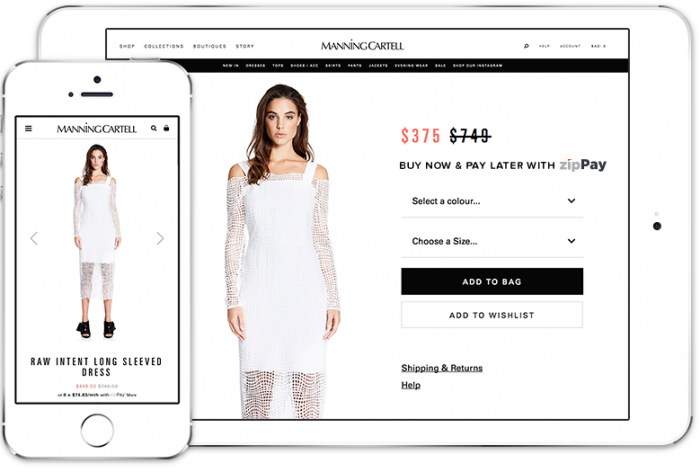

Australian online retailers have begun to offer two new installment payment services, AfterPay and zipPay, which both allow customers to receive their purchased item now, but then pay it off in installments.

How does it work?

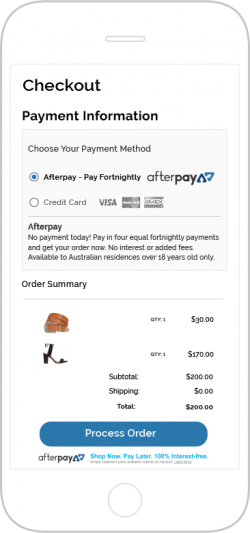

A typical purchase would be where an online customer purchases a $500 appliance. The customer will have to pay $125 upfront, then pay $125 each fortnight until the full $500 has been paid.

AfterPay and zipPay both take the customer’s debit or credit card details and automatically deduct the installment payments from the customer’s account. Customers pay nothing additional to use either AfterPay or zipPay as both ask online retailers to pay a percentage of the total cost of the items purchased using their systems. Depending on the volume of sales, online retailers will pay around 4 per cent of the order value.

What are the benefits?

The good news is that the online store will receive the full payment for their product on the day of the sale and not have to wait for the installments to be paid. This benefit, and the ability to clear stock quickly, is a major plus for online and in-store retailers.

Because the installment payment systems offer such a high level of convenience at no cost to customers, there has been a high number of online and in-store retailers taking them up. This more convenient shopping experience has improved online sales by 20% or more according to the National Retail Association of Australia. Over 3000 online and in-store retailers have already signed up for an installment payment system.

It is important for customers to be aware that if they elect to use AfterPay of zipPAY at checkout (similar to how they would use would use their credit card or PayPal), then if they have insufficient funds available at any of the installment stages they will be charged a late fee of around $7-10.

Is it secure?

Both AfterPay and zipPAY are both completely safe and are certified at PCI DSS Level 1. This means that they meet the comprehensive set of requirements created by the Payment Card Industry Security Standards Council to enhance cardholders data security and to ensure the safe handling and storage of customer credit card information.

Summary

The new installment payment system offers businesses a chance to increase their online and in-store sales by providing an additional payment option to their customers. It is risk-free to the business and full settlement is made on the day of purchase. Customers will be able to receive their purchase earlier than they would have previously been able to and if they are familiar with paying by credit card or PayPal, they be able to easily use AfterPay or zipPAY at checkout. Both installment payment systems are well integrated into the overall payment gateway system and both can be easily and smoothly integrated with online e-commerce applications including:

More details of AfterPAY and zipPAY services and costs can be found on their websites:

AMCD is very experienced in integrating payment systems, particularly with Woo Commerce and Magento online store systems. If you think an installment payment system could be beneficial to your business and to your customers please contact us.

Categorised in: Uncategorised

This post was written by aido

Comments are closed here.